Members of the Central Regional Shipper Committee (CRSC) of the Ghana Shippers’ Authority (GSA) were sensitized on the benefits of insuring their cargo locally on 18th March, 2021 at Cape coast.

The sensitization formed part of government’s effort at ensuring that Ghanaian shippers are protected in their international trade transactions.

The Takoradi Branch Manager of GSA who is in-charge of the Western and Central Regions, Mr. Charles Sey said the GSA, the National Insurance Commission (NIC) and Ghana Revenue Authority (GRA) are collaborating to assist shippers reduce risk such as those associated with loss or damage of their cargoes by placing their cargo insurance locally.

The Takoradi Branch Manager of GSA who is in-charge of the Western and Central Regions, Mr. Charles Sey said the GSA, the National Insurance Commission (NIC) and Ghana Revenue Authority (GRA) are collaborating to assist shippers reduce risk such as those associated with loss or damage of their cargoes by placing their cargo insurance locally.

A Senior Freight and Logistics Officer at the GSA, Mr. Abdul Haki Bashiru-Dine in a presentation highlighted the importance of insuring cargo locally under the recently signed Cargo Insurance Protocol by industry stakeholders.

He noted that only 6% of Ghana’s international trade of over 76 billion cedis in 2019 was insured locally. The expectation is that the figure will further reduce to 4.5% based on provisional figures for 2020.

This situation he said was not the best, given that shippers are inadvertently exposed to the international insurance market which does not necessarily promote their interest.

This situation he said was not the best, given that shippers are inadvertently exposed to the international insurance market which does not necessarily promote their interest.

He noted that non-compliance by shippers of the Insurance Act 2006, Act 724, exposes them to foreign underwriters which create challenges when they suffer a loss or damage.

Mr. Kofi Andoh, Deputy Commissioner of the NIC assured importers and exporters of that the Commission’s commitment to ensuring that all consumers of insurance get value for money. He mentioned that the local insurance market was adequately regulated to provide full protection for the assured.

According to him, the Commission has published guidelines to bring transparency to the claims process when an insured suffers a loss or damage.

Mrs. Mercy Boanpong, Assistant General Manager of Enterprise Group assured importers and exporters in Ghana of adequate capacity of the insurance market to meet the demands of the shipping public.

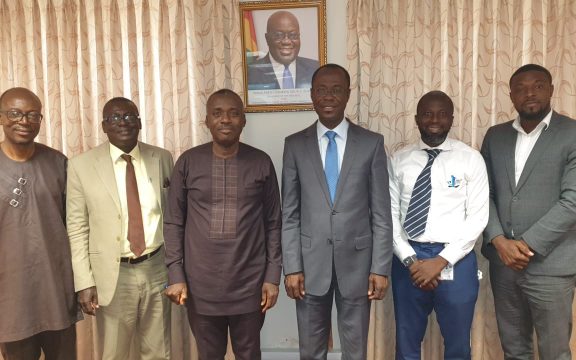

Deputy Commissioner of National Insurance Commission, Mr. Kofi Andoh

She noted that CIF incoterms covering imports only provides a minimum of clause C under the international Institute Cargo Clauses providing only minimum cover and does not usually protect the importers needs.

Mrs Boanpong noted that the rate of insurance premiums for marine is usually between 0.25% and 1% of the value of the consignment.

She therefore encouraged shippers to ensure their cargo locally for their benefit and in compliance with the National Insurance Act, 2006, ACT 724.