By the beginning of the second quarter of 2023, the issue of the continuous decline in port traffic in Tema and Takoradi had been well documented, prompting the Ghana Ports and Habours’ Authority (GPHA) to summon a meeting with stakeholders on 30th March 2023 to address the matter.

The phenomenon is evidenced by several stories published in the media, including one by Naa Dzagbe l ey Ago for gbcghanaonline.com on 11th April 2023 with the headline “Low Cargo Traffic: DG Tema Port Disappointed” and another by Maclean Kwofi with the headline “Port Traffic Slumps for 10 Months” for graphic.com.gh on 18th April 2023. These notable media stories emanating from the GPHA’s meeting with stakeholders on the worrisome trend lend credence to the concerns it has generated. Statistics from the GPHA on container and cargo throughput between January and May 2023 indicates that cargo throughput in the Tema Port reduced by more than 1.8 million metric tonnes in comparison with the same period in 2022. Container throughput also declined by 21% during the same period, from 528,391 in 2022 to 416,684 in 2023.

The subject has since become a topic of public interest as industry players continue to propose solutions to avert further decline in port cargo traffic given its implications on the economy.

Ghana’s Maritime Trade Performance Statistics

Ghana’s Maritime Trade Performance Statistics

Data sourced from GPHA indicates that the trajectory of port traffic volume (Cargo in Metric Tonnes) has shown an erratic pattern in the periods before and after the outbreak of the COVID-19 Pandemic (2019 and 2022). During these periods, the total volume of cargo processed at the ports of Tema and Takoradi for export, import and transit was 27.6 million metric tonnes in 2019 and 26.01 metric million tonnes in 2020 following the outbreak of the COVID-19 pandemic. The pandemic led to the closure of Ghana’s borders, hence impeding international trade. Several measures were put in place such as the screening of all port users, sensitization exercises as well as the designation of two separate holding areas to address potential cases of the pandemic at the Takoradi port. These and other measures ensured an increase in port traffic in terms of cargo volumes from 26.01 million metric tonnes in 2020 to 27.9 million metric tonnes in 2021. Notwithstanding the 2021 performance, there was a significant reduction in cargo volumes in 2022 as the ports of Takoradi and Tema processed 2,493,299 million metric tonnes less than they did in 2021, which represents 8.9% drop, the highest in the last decade. Container traffic dropped by 20.34 per cent to 1.2 million 20 foot equivalent units (TEUs) in 2022 from the 1.56 million TEUs recorded in 2021. The table below illustrates the statistics for Ghana’s Maritime Trade for Import, Export and Transit Cargo from 2019 to 2022.

Reasons for the Decline in Port Traffic

The high cost of doing business at the ports, cited by stakeholders in the shipping and logistics sector, has been identified as the primary reason for the significant decline in port traffic last year. Key industry players, includingthe Ghana Union of Traders Association (GUTA) and the Committee of Freight Forwarders (CoFFA), have consistently raised concerns about the issue and even threatened to stage protests.

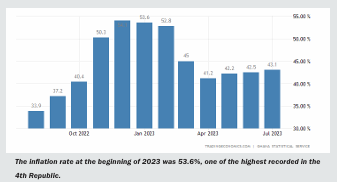

Several factors such as the elevated inflation rates have contributed to the high cost of doing business at the ports. Data from the Ghana Statistical Service reveals that inflation shot up by 25.2% between June 2022 a n d December 2022. Unfortunately, the rate further shot up to 53.6% at the beginning of 2023, one of the highest ever th recorded in the 4 republic.

This prompted the government of Ghana to seek a bailout from the International Monetary Fund (IMF) to stabilize the economy, in the belief that, a reduction in inflation will enable shippers to operate more cost-effectively. Perhaps the President of GUTA, Mr. Joseph Obeng’s summary of the concerns of his members in a media interview brings better clarity to the situation better. He stated that “the current cost of doing business is exorbitant, causing frustration among entrepreneurs who find themselves at a disadvantage compared to their counterparts i n neighboring countries. Consequently, instead of making profits, most businesses are conducting transactions and purchasing goods through the ports of neighboring countries such as Togo.

The complete reversal of the discounts on benchmark values for imported goods and vehicles further aggravated the increased cost of doing business at the ports, and thereby negatively impacted port traffic. Speaking at a GPHA Media Forum to assess the impact of the reversal of the benchmark value, which took st effect on 1 January, 2023, Mr. Yaw Kyei, the President of the Association of Customs House Agents Ghana (ACHAG), stated that “importers would now have to pay higher duties, resulting in increased business costs”. His c omment followed the announcement by the Ghana Revenue Authority (GRA) in December 2022 which eliminated the previous 10% discount on vehicles and the 30% discount on all other goods. The new policy direction meant that importers no longer enjoy the benefits of the discounts.

In the second quarter of 2023, t he GPHA informed key stakeholders of its intention to review and restructure of port tariffs due to the rising costs of providing port services. The proposed tariff adjustments, affected thirteen (13) different schedules including port dues, port operator license fees, vessel handling charges, stevedoring charges, as well as receipt and d el i ver y charges. The adjustments no doubt contribute to or have the potential to exacerbate the ongoing decline in port traffic. This is because as stated earlier, the high cost of doing business at the port was identified as the major reason for the decline in port traffic, hence any upward adjustment of the port tariffs, some of which are to be paid in dollars would most likely worsen the situation.

Impact of the Decline in Port Traffic on Ghana’s Economy

A decline in port traffic in Ghana has far-reaching implications for t h e soci o- e c o n o m i c development, employment, and trade, posing challenges such as revenue loss, job cuts, and disruptions to supply chains.

- Freight Forwarders, who play a crucial role as i ntermediaries for importers during the process of clearing cargo / goods at the ports, have experienced a significant decrease in their workload since mid-last year. Cephas Nseidu, a Freight Forwarder based in Tema, stated in an interview with the B&FT on April 19, 2023, that he used to clear about eight (8) to ten (10) containers per week from the Tema Port before taxes were increased and Shipping Lines also increased their costs. Since January 2023 however, he has only been able to clear three (3) containers weekly, representing a substantial decline in his normal operations at the harbour. This situation has compelled many Freight Forwarders and other port operatives to seek alternative means of survival.

- The decline in port traffic does not only affect the livelihoods of Freight Forwarders but also has financial implications for the government. The government relies heavily on income generated through Customs Duties, tariffs, and other charges associated with port operations. With reduced traffic, these revenue streams diminish, creating financial strain for the GPHA which manages the ports on behalf of government and consequently impacts government’s ability to fund critical infrastructure projects and public services.

- The impact of decline in port traffic extends beyond revenue loss. Ports serve as vital gateways for imports and exports, facilitating trade and supporting various industries. Decreased traffic levels can disrupt supply chain operations, l eading to delivery delays, increased costs, and potential shortages f o r b u s i n e s s e s nationwide. This, in turn, can contribute to an economic slowdown and hinder Ghana’s overall growth prospects.

- Additionally, the decline in port traffic undermines investor confidence in Ghana’s shipping and l ogistics sector and impacts her image in the sphere of international trade. Investors may hesitate to allocate resources to industries heavily dependent on efficient port operations.

- Furthermore, reduced p or t activity can negatively affect Ghana’s reputation on the international scene as a reliable trade partner. Such a dented reputation has the potential to lead to a reduction in Foreign Direct Investment (FDI) and weakened trade relations with international partners.

Conclusion

Overall, the statistics show that port traffic has undulated in the last decade. The drastic drop in 2022 is alarming and requires urgent action to avert the downward trend witnessed since then.

In light of these challenges, it is crucial for stakeholders to consider innovative and strategic efforts to address the decline in Ghana’s port traffic. Measures to improve the cost effectiveness of port operations, enhance infrastructure, and promote trade facilitation should be e x p l o r e d and swiftly implemented to revitalize port traffic, stimulate economic growth, and restore investor confidence.

The situation also provides an opportunity for investment in infrastructure, enhanced operational efficiency, and promotion of diversification. By adapting to the changing dynamics in global trade and port operations management, and leveraging innovation, Ghana’s ports can overcome the challenges and emerge stronger, to contribute to sustainable economic growth and development.

The situation also provides an opportunity for investment in infrastructure, enhanced operational efficiency, and promotion of diversification. By adapting to the changing dynamics in global trade and port operations management, and leveraging innovation, Ghana’s ports can overcome the challenges and emerge stronger, to contribute to sustainable economic growth and development.

By: Osei Owusu Amankwaah